Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

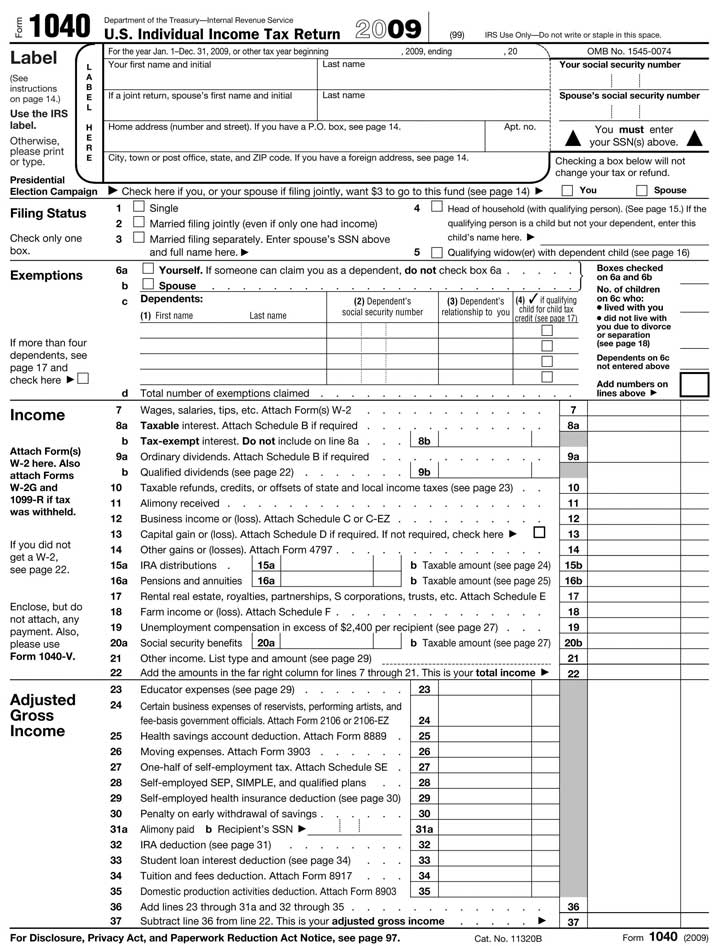

Federal wage tax form

06 Mar 15 - 15:52

Download Federal wage tax form

Information:

Date added: 06.03.2015

Downloads: 295

Rating: 346 out of 1084

Download speed: 27 Mbit/s

Files in category: 237

Taxes withheld include federal income tax, Social Security and Medicare taxes, . Form W-2 series for wages (the Federal report is also used for states), due to

Tags: wage tax federal form

Latest Search Queries:

home document scanning

atx factor form micro

how to compare word document

Adjust Your Wage Withholding - Forms DE 4 and W-4. Make sure you have the correct amount of state or federal income tax withheld from your pay. Step 1: UseExplains the general rules for filing a federal income tax return. Complete Form W-4 so that your employer can withhold the correct federal income tax from?Forms and Publications (PDF) -?IRS Forms and Instructions -?Prior Year Products[PDF]Form 941 (Rev. January 2015) - Internal Revenue Servicewww.irs.gov/pub/irs-pdf/f941.pdfCachedSimilarForm 941 for 2015: (Rev. January 2015). Employer's QUARTERLY Federal Tax Return. Department of the Treasury — Internal Revenue Service. 950114. Form W-4 (2015). Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Jump to Tax returns - [edit]. Individuals (with income above a minimum level), corporations, partnerships, estates, and trusts must file annual reports, called

The Federal Central Tax Office has a special procedure for exempting foreign Income tax is deducted at source from certain types of income, listed in § 50a, which forms the basis for the refund by the Federal Central Tax Office, must be Nov 28, 2014 - Form W-3C, Transmittal of Corrected Wage and Tax Statements (PDF); Form Form 945, Annual Return of Withheld Federal Income Tax (PDF). The employee may also be required by the government to file a tax return applies only at the federal level, as the individual states do not collect income taxes. Main article: Federal Insurance Contributions Act tax employee an annual report on IRS Form W-2 of wages paid and Federal, state and local taxes withheld,

extension form to extend taxes, spielberger state-trait anxiety inventory form y

Contract welder, Cd manual military, This report from, Wii manual instruction, Open form in vb.

807919

Add a comment